WeWork: The Mumbo-Jumbo and the Meaning

The scandal-ridden flex-office business is still around, despite the pandemic. Its ousted founder gets the documentary treatment.

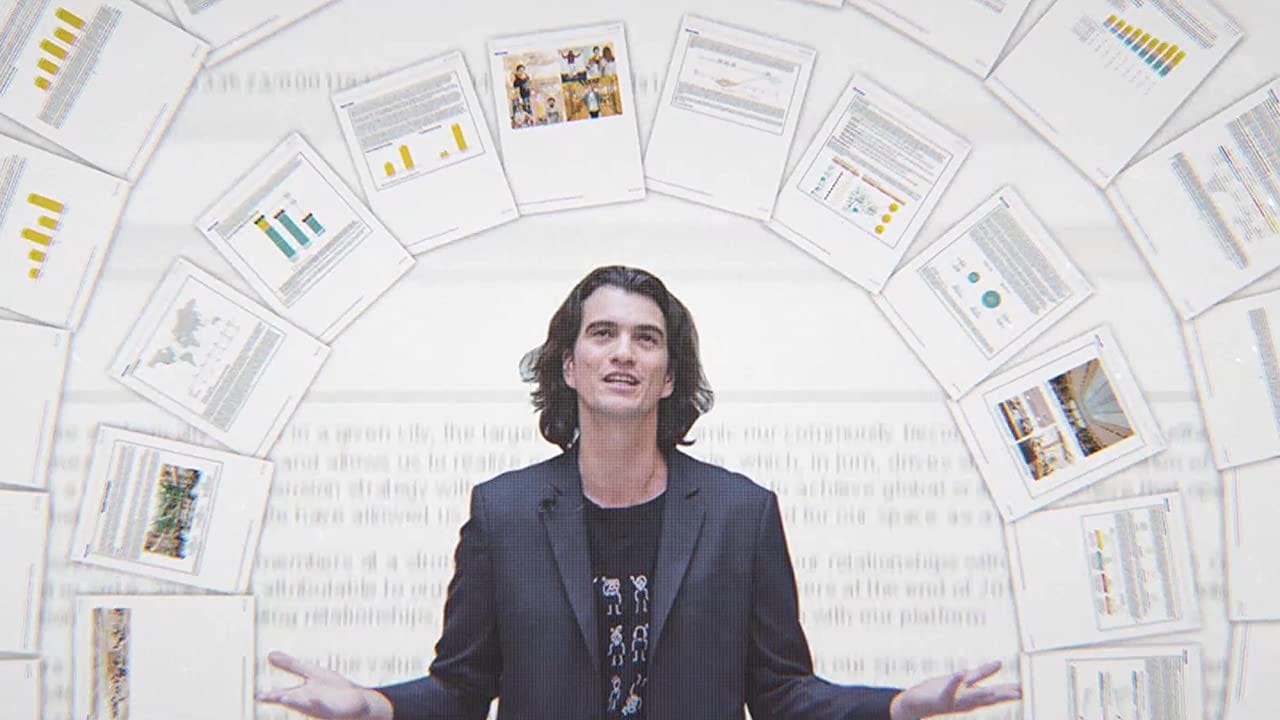

WeWork is a commercial real-estate company intent on having people think it isn’t. Cofounder and former CEO Adam Neumann—forced to resign in 2019 following scandals of staggering chutzpah—resists this accurate characterization in media appearances stitched together in the new Hulu documentary WeWork: Or the Making and Breaking of a $47 Billion Unicorn, of which he is the “star.”

WeWork subleases buildings that it holds under long-term leases but does not own. By the mid-2010s, it had become “the largest lessee of office space in all of New York City.” So: clearly real estate, right? Yet Neumann insists that this middle-man status somehow means WeWork is distinct from a real-estate firm. (Later, we learn that Neumann himself bought buildings and then had WeWork lease them from him. Did I mention chutzpah?)

Rather than thinking of WeWork as merely a company that subdivides real estate, Neumann claims in one interview that the firm’s purpose is to “elevate the world’s consciousness.” In 2010, flipping distressed commercial buildings on a flexible basis was a novel approach, and seeking out a customer base that might want to rent small amounts of space without long-term commitment seemed superficially suited for the gig economy. But all that has nothing to do with consciousness elevating.

Did employees, customers, and journalists really buy into that patter? The documentary suggests, echoing the once-invincible status of Enron, that there was a reluctance to ask difficult or probing questions about WeWork’s questionable profitability or chaotic internal affairs. Some of this was probably a kind of bandwagon effect; it can be fun to believe in something, or even to be taken for a ride. But also crucial was Neumann’s charisma, with which he was able to hold off a lot of scrutiny. He appeared to believe fervently things that would, once detached from his aura, come across as nonsense or BS.

Most of mainstream journalism was useless on this front. It took Justin Zhen of Thinknum, a data company, to analyze publicly available data and determine that WeWork’s churn, or turnover rate, was high and accelerating. And it took marketing professor Scott Galloway to do some relatively simple math on building values and determine that WeWork was massively overvalued.

While at one point in the documentary Neumann makes fun of startups that don’t turn a profit, it turns out he was in the same boat. Galloway, whose screen time is brief but incisive, explains that WeWork effectively invented financial metrics: “We want to pretend to be profitable by ignoring these expenses.”

WeWork paid below-average salaries padded with stock options and a false promise. It cut its employees’ office space and crammed them together under the guise of concentrating energy and cooperation. It encouraged a cutthroat workplace atmosphere. In one anecdote, WeWork management determined that 7 percent of employees needed to be laid off, to recoup money the firm was burning through. Neumann privately and vulgarly bragged that he cut more than 7 percent of his immediate team. It brings to mind, again, Enron and that firm’s scheme of firing a fixed percentage of staff, based on ranking, every year.

The documentary suggests but doesn’t really plunge into an important global-finance rabbit hole: the saga of holding company and venture capitalist fund SoftBank, a major investor and now the majority owner of WeWork. SoftBank is based in Japan but a lot of its money comes from Saudi Arabia via its sovereign wealth fund. And so the WeWork pump-up was about more than Americans being easily impressed by a startup; there was also a foreign “gotta put money in something” angle.

One critique of the documentary is that writer and director Jed Rothstein focuses too much on Neumann’s quirky, woo-woo, outsized persona, and not enough on the less sexy but more fundamental problems with the company’s work environment and finances. As Elizabeth Lopatto put it at The Verge, “The problem of making a documentary about a showman is that it’s hard not to be ensnared by him.” There may also be a less innocent explanation for this focus on Neumann: It allows the documentary to appear tough, while only dealing a glancing blow to broader corporate malfeasance.

Nonetheless, the company’s idiocy is captivating:

The regional CEOs dubbed “C-We-Os.”

WeOS, an “operating system for physical spaces.”

Neumann singing praises to the “We Revolution” and the “We Generation”—and then even trademarking the word “We.”

The juxtaposition of free unlimited beer with a ban on expensing meals containing meat.

Neumann’s dream of being “president of the world.”

The “summer camp,” a mandatory annual company event consisting of mumbo-jumbo seminars by day and alcohol-fueled debauchery by night—with tracking bracelets, just to make sure you’re really attending.

And, in Jed Rothstein’s defense, perhaps a company so tightly associated with a single figure should be analyzed through that figure. A CEO is not a king or a dictator, but there’s a meaningful difference between a blue-chip firm with staid leadership and a company with a charismatic founder and quasi-mythical origin story. Still, a more fruitful way for WeWork to have directed its focus on Neumann might have been to more deeply probe the company’s authoritarian impulses and its broad claims over its employees’ lives.

The basic appeal of WeWork to millennials and perhaps to those at the upper range of Generation Z is rather obvious but almost never bluntly stated: It’s an extension of college. This becomes even clearer with the introduction of WeLive, an experiment in “co-living” which, according to interviewee August Urbish, involved writing an application essay. Urbish adds that the WeLive renters—who were also renting WeWork offices in the same building—were mostly “young with no actual responsibilities,” nearly all single, and enjoyed “the ability to pause their personal lives to try out this new thing.” Most people, he notes, rarely left the building. In some ways, the WeWork philosophy is a distant relative of the social setting of academia, with everything but the easygoing social milieu bred out. But the competitiveness to get into WeLive—and an anecdote that members were ordered to performatively socialize in order to sell the project during frequent investor tours—feels something like The Hunger Games disguised as freshman orientation.

In fact, the company’s entire pitch to millennial freelancers and startups, its ethos of flexibility and community and togetherness, was cynical. WeWork’s raw material was the instability, desperation, lack of attachment, and delayed marriage and homeownership that stereotypically but somewhat accurately characterize the millennial generation. WeWork was a stand-in for meaning, for young people yearning for meaning.

Relatedly, the notion that WeWork was an example of the “sharing economy”—a term rarely used unironically anymore but embraced by Neumann—is as silly as the notion that it isn’t a real-estate firm. The imperative to grow necessarily conflicts with the ideal of “sharing.” Uber ended up adding congestion to urban streets and leasing cars to its drivers; WeWork ended up leasing slapdash offices to Microsoft at cut-rate prices.

Despite WeWork’s high-profile implosion and the ousting of Neumann as CEO in 2019, the company remains in business, albeit under a much quieter CEO and at a much lower valuation. (The firm was valued, preposterously, at $47 billion in 2019, but now there’s talk of $9 billion.) The company still has plans for an IPO and says it expects to be profitable by some time in 2021. The pandemic and the rise of remote work is a weird but fitting coda to the collapse of an office-sharing company. But it’s also another low point in the value of commercial real estate, which is exactly how the company got its start. Remote work may even open up a new market; employees working from home long-term may want a small office space for a couple of days a week, outside of the superstar metros. Could distressed suburban office parks be WeWork’s next frontier? It’s possible.

This pedestrian future contrasts with the weak ending of the documentary, which offers an elegy to a lost vision of community. WeWork was not the embodiment of community but its antithesis—or, at best, a weak substitute.

And the erstwhile star of the show? He remains an outrageously overpaid consultant for WeWork, but his superstar days are probably over, and probably lasted too long. Steve Jobs was a brilliant jerk. The Enron crew were brilliant fraudsters. Adam Neumann is a jerk and a fraudster—and not very brilliant.