How I’m Helping Donald Trump Post His $557 Million Bond

A story about SPACs, DWAC, Truth Social, and human nature.

Today I’m going to explain how Donald Trump (might) be able to make his $557 million bond and how I might play a small part in helping him out of this jam.

But man alive, this is going to be a journey. We have to go back in time to the COVID meme stock pandemonium. We have to talk about social media, and Wall Street, and the tech world. Then we have to talk about politics and the legal system.

And before we do any of that, we have to start with human psychology. So buckle up.

But before we start, if you’re new here, I hope you’ll sign up to support what we’re doing at The Bulwark. We give away 90 percent of our work for free and we don’t clutter up the site with ads. We’re supported by our members. Come ride with us.

Also, this edition of The Triad is unlocked so feel free to share it. Let’s go.

1. DWAC SPAC

Here is a thing you should do whenever your favorite team reaches the championship finals: Bet $100 against them.

This wager is a hedge against disappointment. If your team wins the World Series you will be elated. You and your buddies will text about it for weeks; you will celebrate with your children and create beautiful memories. You will easily get $100 worth of happiness from the experience.

And if your team gaks it and loses? Well, you win $100. Money can’t buy happiness (supposedly) but it can buy you a nice baseball card to console yourself after the Phillies lose the World Series.1 (Again, supposedly.)

It was on this theory that, in the fall of 2021, I purchased two shares of DWAC.

What is DWAC? The Digital World Acquisition Group (DWAC) is a SPAC—a Special Purpose Acquisition Company—which is a legal arrangement that became popular on Wall Street during the pandemic. Let me explain.

If you own a company and want to take it public, so that you can sell shares in it, you have to do a lot of stuff. You have to hire lawyers and fill out forms and make declarations to the SEC. You have to open your books and disclose risk factors. It’s a hassle and if you try anything too cute, you could wind up in jail for securities fraud.

On the other hand, you could create a Special Purpose Acquisition Company. A SPAC is a shell of an organization. You create it, the SPAC sells shares to investors, and these shares can then be traded on a public exchange. The SPAC is a bit like the financial version of Red Bull—it’s a publicly traded brand with no actual business behind it. It has no product, no revenue, no expenses.

The purpose of the SPAC—the special purpose—is that it can then go out and buy a privately held company. Once that happens, voila! That privately held company is now publicly traded and it dispensed with all that bothersome disclosure stuff for the SEC.

It should be obvious why this arrangement might be attractive to . . . a certain kind of businessman.

So it’s October 2021. Trump has started his Truth Social network. In order to cash in on this scam paradigm-shifting platform, he needs to open it up to his cult retail investors, so that Cletus and Lurleen can transfer their wealth to him invest in the future of social media.

But Trump didn’t want to put Truth Social under an IPO microscope, for fairly obvious reasons.

How do you get to IPO $$$ without going through IPO-style disclosures?

SPAC it, baby!

In the fall of 2021, the product Truth Social was rolled out. This product was owned by a shell called Trump Media and Technology Group (TMTG). From the jump, TMTG was the target of a newly formed SPAC—the aforementioned Digital World Acquisition Group.

DWAC had sold shares totaling $290 million and had gotten itself listed on the NASDAQ. Both DWAC and TMTG seemed to have a very clear understanding of each other’s needs and desires. Call it destiny. Call it kismet. But absolutely do not call it prior collaboration, because that would be a violation of securities law.2

DWAC announced its plan to purchase Truth Social (via TMTG) and shares of DWAC went 🚀 🚀 🚀🌙🌙🌙.

Trump and TMTG then went and got themselves a round of PIPE investment, which doesn’t really matter except that it meant that Trump stood to make several multiples of $290 million once Truth Social was publicly traded as DWAC.

2. Enter JVL

When DWAC started going to the moon, I purchased two (2) shares. I considered it a hedge against disappointment.

If DWAC (Truth Social) crashed and burned, I’d lose a couple bucks—but I’d be cosmically, intellectually, spiritually satisfied.

And if DWAC made a $100 billion for Donald Trump, then I’d cash out and buy a couple Shohei Ohtani rookie cards to ease the pain.

The deal between DWAC and TMTG has taken a loooong time to get to the consummation phase for a number of reasons.3 But I stayed strong. I was 💎💎 💎🙌🙌🙌 all the way.

And last month the SEC finally gave DWAC permission to move forward with the purchase.4

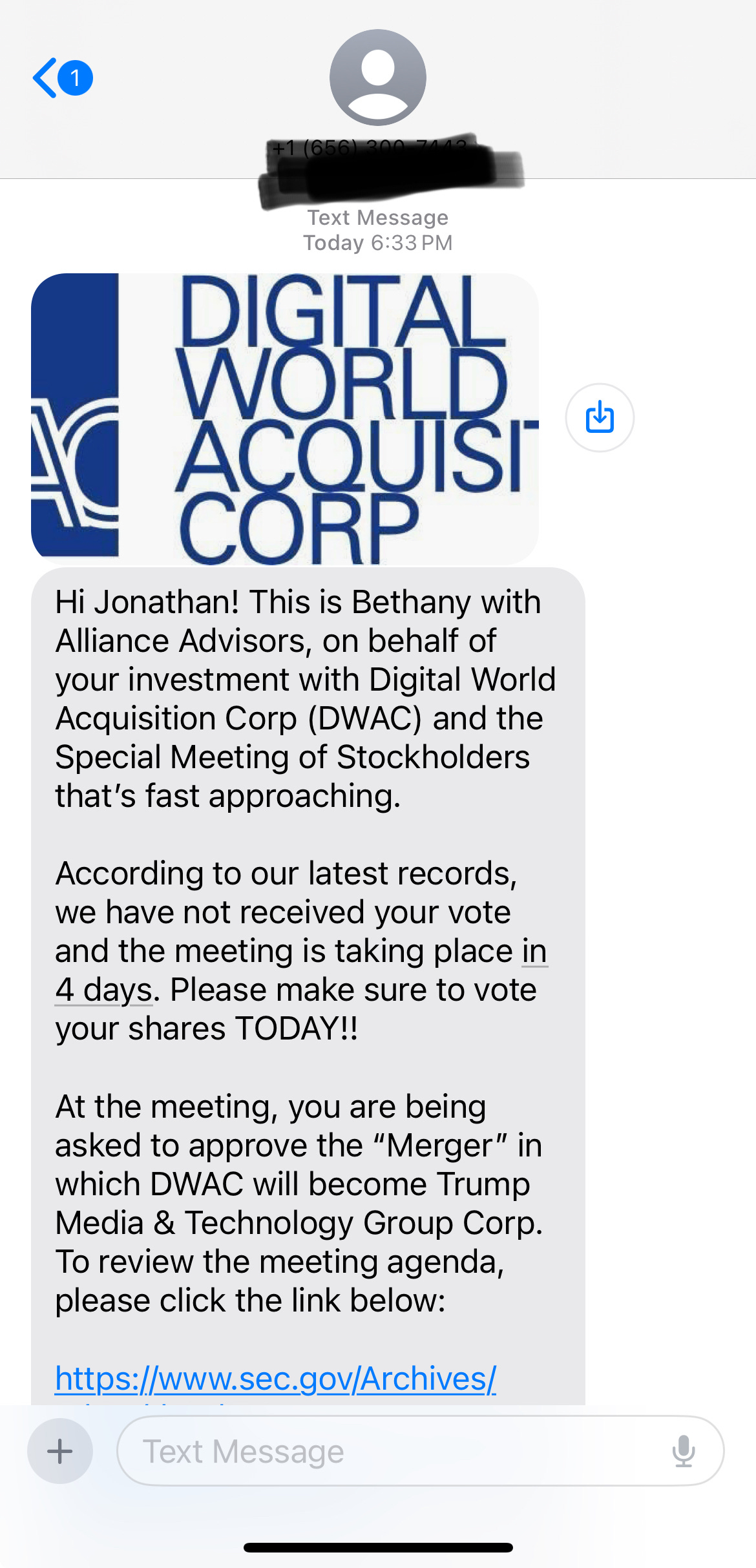

On March 9, I started getting texts from Alliance Advisors, which is a vendor working for DWAC whose job is to corral shareholders to vote on March 22. Because DWAC must have shareholder approval in order to complete the purchase of Truth Social. And because DWAC is mostly held by retail investors and retail investors are notoriously bad at participating in votes, every share counts. Even my two shares.

Here’s what happens if the vote fails: Shares of DWAC are currently trading at about $35. If the shareholders do not approve the purchase of Truth Social, then DWAC will be dissolved, shareholders will forfeit their shares, and be compensated with $10 per share.5 That would be bad for me. I would lose some money.

But it would be much worse for Trump, because it would deny him access to DWAC’s bankroll and prohibit him from making the *big* money once his brand hits the stock market and more members of his cult retail investors can get in on the action.

Also: Trump is currently having a liquidity problem. You might have read about it. He needs to post a half-billy bond by March 25, but none of the woke, socialist, DEI banks are willing to write one, because they’re unfairly prejudiced against him or whatever.

On the other hand, if DWAC shareholders approve the purchase, then Trump unlocks access to a crazy amount of money. His shares of TMTG get converted into shares of DWAC at such generous terms that, at current market value, they’d be worth $2.8 billion.

Meaning: Trump could then use his DWAC shares as collateral for his bond and still have $2.3 billion of found money to burn.

There are some technical complications that I won’t bore you with, but the net-net is that they could probably be resolved.6

If shareholders approve DWAC’s purchase of Truth Social, and . . .

If the purchase can be executed by March 25 . . .

Then Trump will probably be able to get a bank to cover his bond.

And I get two votes on this hinge of history. I think it’s pretty obvious what I have to do.

Before we get to the endgame, I have two thoughts. The first is that Truth Social and DWAC are fine examples of late-stage capitalism. Here’s Bloomberg’s Matt Levine:

Trump was fined $454 million because of his habit of inflating his own estimates of his wealth, basing his estimates on how he feels rather than objective measures like cash flows or comparable transactions. But then DWAC came along and gave him the opportunity to, in effect, turn his celebrity into a publicly traded security. Lipschultz:

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

The old world (“just making up your net worth based on your feelings is fraud”) is dying at the exact same time that the new one (“actually there’s a stock ticker for how Donald Trump feels and it has a market cap of several billion dollars”) is being born, and if he times it just right maybe he can use the new stock to pay the old fine.

Sigh.

But I’ll go you one darker. Even if Trump fails to post bond, the courts are likely to blink. Trump understands that everything—even the law—is a negotiation. By failing to post the required bond in the required time, he’s forcing the court to either (a) start seizing property or (b) climb down and figure out a way to make the bond a sum that he is willing to pay.

Spoiler: The court will not order the seizure of properties belonging to the Republican presidential nominee eight months before the election. That’s not how this court works. It may not be how any court in America works.

Given all of this, it’s clear what I should do with my two shares of DWAC. I should vote to approve of the purchase of Truth Social, make a little money, and then hope that—at the very least—Trump’s windfall enables the court to hold him to the full sum he owes.

I should help Trump out.

But let me tell you what I’m going to do: I’m going to vote against the purchase of the Trump Media and Technology Group. Then tonight, I’m going to buy two more shares of DWAC and vote against it again. If I had the scratch, I’d buy a thousand shares, just to vote against the purchase some more. I would set that money on fire for the chance to have reality impose some consequences on this man.

If only our justice system were willing to risk some skin in the name of upholding the law, too.

A share in DWAC might be worthless soon, but the value of a Bulwark+ membership lasts forever.

3. Goldendoodles

Speaking of late-stage capitalism:

Don’t click and read it. Your head will explode.

Tim Miller has another suggestion: At the start of each season, bet $100 on your favorite team to make it to the championship. You should get pretty good odds and if the bet pays off, that money defrays the cost of getting tickets to the game.

The legal fig leaf is that a SPAC cannot prearrange to purchase a newly formed company, because that would be a gross circumvention of SEC regulations. The SPAC has to pretend that it’s totally autonomous and just happened to find its acquisition target.

Mostly having to do with the SEC poking around how closely intertwined DWAC and TMTG were before the SPAC was formed. See Kim Wehle’s piece here, if you’re interested.

Naturally, there is a lawsuit: The partnership United Atlantic Ventures alleged that Trump undertook “11th hour . . . maneuvering” to dilute the value of its holdings and increase the value of Trump’s holdings. I know. This is my shocked face.

That’s the original offering price for DWAC shares. Obviously, many people purchased DWAC shares for much more than $10. At its height, DWAC was trading around $100.

Trump is subject to a lock-up agreement limiting his ability to dispose of his DWAC shares. But there are ways around this.

Ha! My dogs stay at the Olde Towne resorts. They're great. I didn't know they got bedtime stories.

As usual JVL writes with a clarity that enables even me, an ignorant simpleton on certain subject matter, to grasp the issue…I also confess to feeling what’s become a familiar refrain in my head: WTAF, we are living in the most bizarre world…