How Infrastructure and Climate Are Linked Issues

Investment in green recovery—as Biden’s new plan proposes—offers both economic and environmental returns.

Hot on the heels of the large COVID recovery package, President Joe Biden on Wednesday announced a major new policy priority: infrastructure. Looking to make good on his campaign promise to “build back better,” the president is proposing a package of spending and investments totaling $2 trillion across this decade, with a particular focus on climate change. If done correctly, the climate-related parts of the package—which involve plans to adapt to the reality of climate change by making our infrastructure more resilient as well as funding for research to mitigate climate change—should win broad support from Americans and their representatives on both sides of the aisle.

As the United States limped through the pandemic, global climate change has continued unabated. Massive wildfires scorched the West, floods inundated cities and farmland in the Midwest, and hurricanes battered the Gulf Coast. Scientists are confident that some types of extreme weather events are becoming more frequent and more extreme. Meanwhile, our infrastructure has continued to show its years. Just weeks ago, freezing temperatures overwhelmed the electricity grid in Texas, leaving millions of people in the energy capital of the United States in the dark and freezing cold—and resulting in more than a hundred deaths. Our infrastructure was unprepared for extreme conditions in each of these cases because of market failure, poor planning, a changing climate, or some combination thereof.

None of these has been as singularly damaging as COVID. Still, the combination of aging, haphazardly planned infrastructure and the effects of climate change will continue to intensify these threats long after the virus subsides. As governments and businesses make recovery plans, they must include robust measures to accelerate the transition to clean energy and make communities more resilient to the natural hazards that climate change will place on steroids.

A well-designed green recovery can generate billions of dollars of economic activity and support millions of jobs. If done properly, many such investments will improve economic growth and pay for themselves. And the savings in energy and disaster-relief costs will improve our country’s fiscal condition. This is a formula that should appeal to both sides of the aisle.

It’s more than a call for subsidizing green energy. As warranted as some subsidies are, green energy from wind and solar sources is already the lowest-cost option in many places. But public investment in infrastructure will modernize and expand the electricity grid so that consumers can realize the benefits of low-cost energy. There are 734 GW of privately funded wind, solar, and gas power plants in the interconnection queue, waiting for someone to build the necessary transmission lines to handle the power generated. Like many kinds of infrastructure, electric transmission infrastructure has up-front costs but pays off over time. But without federal leadership and blessing, private transmission builders cannot cooperate with state and local regulators to site long-distance transmission that carries power across state lines rather than within it.

And like the highways of the twentieth century or the rail lines of the nineteenth, power transmission can become an engine of economic opportunity. Texas financed a major connector system between its wind-rich north and its urban-load centers that is already paying off its cost at a rate of return of 24 percent. Despite claims to the contrary, the disaster in Texas was not largely the result of failures in wind generation or any one technology. The real culprit was planning that failed to require winterization against a deep cold wave, even though neighboring states foresaw it, prompting a wide failure of natural gas plants and distribution systems. An electricity system with more long-range transmission would allow states to import more power in emergencies and be more robust to such failures. Unlike the rest of Texas, El Paso’s power system is connected to other regions of the country, and it came through the freeze without significant blackouts.

Likewise, federal funds could help states and utilities make investments to save for the near term. According to one analysis, 86 percent of U.S. coal plants will be more expensive to operate than to replace with locally generated solar or wind power by 2025. Under current regulations, consumers will bear the excess cost of their continued operation. With low-interest federal financing, utilities could retire most of the U.S. coal fleet by 2030, saving consumers billions of dollars a year while making the air safer to breathe—air pollution caused by electricity production resulted in an estimated 8,500 premature deaths in 2018—and reducing greenhouse gas emissions.

In the transportation sector, the total operating costs of electric vehicles (EVs) are steadily decreasing, making them increasingly appealing to consumers and fleet owners. But a lack of essential charging infrastructure, especially on highways, limits the fastest possible deployment of this technology. Existing highway and utility regulations create substantial barriers to companies working in this space. In keeping with Eisenhower-era regulations, commercial charging is not permitted on the Interstate Highway System’s rest stops, and the price of electricity used for charging in existing private networks can be exorbitant. Public investment in charging—such as the Biden proposal to fund, through grants and incentive programs, “a national network of 500,000 EV chargers by 2030”—combined with regulatory reforms could make driving and shipping in the United States substantially cleaner and cheaper in the next decade.

Despite what many fear, the shift to green energy will be affordable for consumers and reduce overall costs for society. Since green energy is falling in cost as it is deployed more broadly and produces less greenhouse gas emissions, which cause lasting damage, the cost savings get larger the further you look into the future. But addressing climate change requires broad and deep investments in infrastructure outside of the energy sector. An investment program aimed at resilient infrastructure, sustained over several years, could create millions of construction, manufacturing, and logistics jobs.

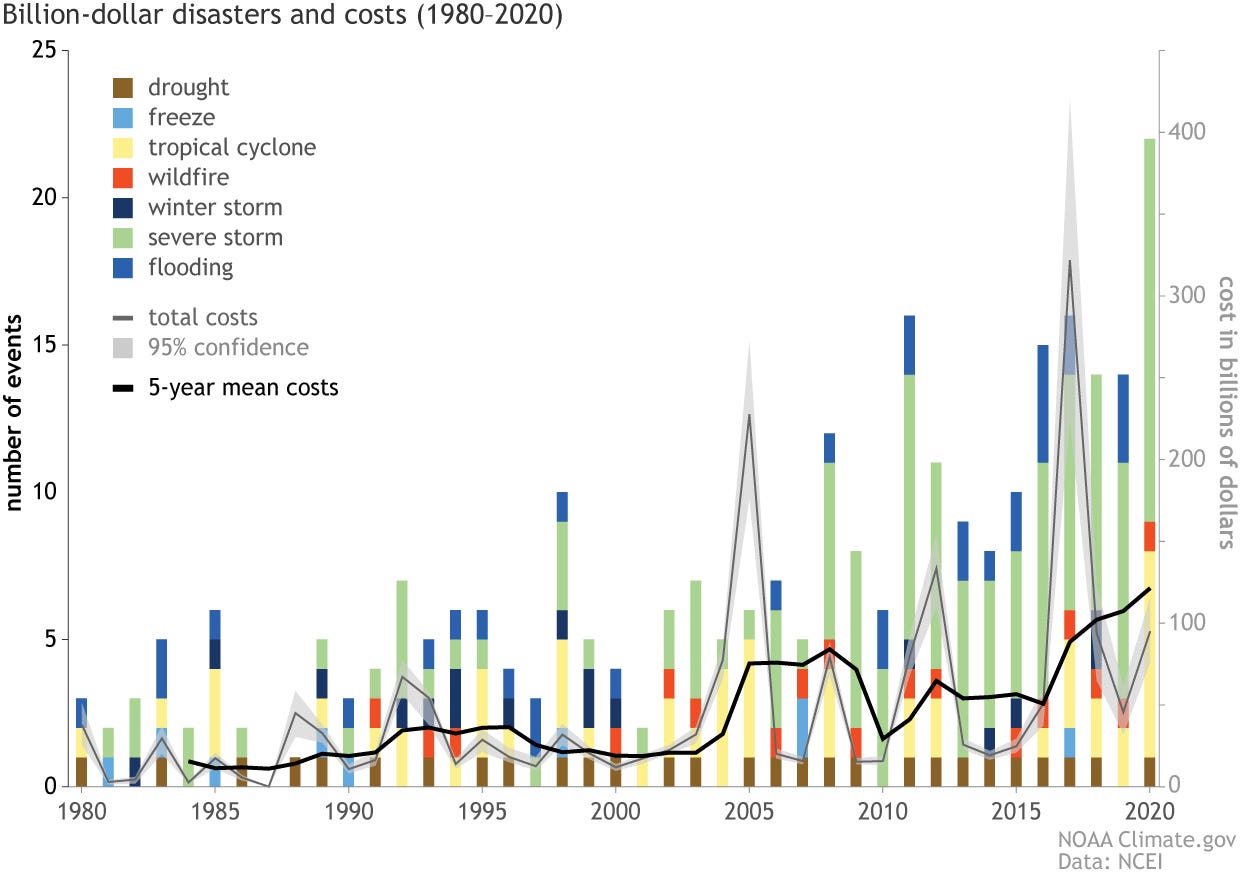

The reality is that a changing climate threatens America’s decrepit infrastructure and makes such investments ever more necessary. Every year, weather- and climate-related natural disasters cost the United States tens of billions of dollars—totaling more than $600 billion over just the last five years:

The federal government bears a considerable share of that annual cost. Last year’s Atlantic hurricane season saw a record 30 storms, with a record 12 of them making landfall in the United States, and a record 7 of those causing above $1 billion in damages. Since the government already pays so much of the disaster bill, it should invest in cutting those costs, which will protect communities and ultimately reduce government spending.

Upgrading and hardening infrastructure to protect homes and businesses from catastrophic risk is another area where investments now could provide future savings. Years of deferred maintenance at the Oroville Dam in California ended up costing $1 billion after the spillway failed during the California floods of 2017. Repairs had been recommended a decade before the dam failed; had they been done, the savings would have been more than ten times the maintenance cost. The country is replete with infrastructure that is similarly at risk. Some of it, where the necessary maintenance has been underfunded for years, is publicly owned. Some of it is privately owned but undermaintained—often under the implicit assumption that the federal government will pay when disaster strikes.

Disaster hardening is almost always profitable, which is why it is inexcusable for the United States to further delay making such investments. The Dutch manage flood risk with a “prepare, don’t repair” approach while spending a fraction of what the U.S. government spends on flood control each year. Since the government already pays almost half the bills when disaster strikes, spending sensibly on infrastructure resilience is a fiscally conservative approach. These projects do have high up-front costs. But negative real interest rates mean that the federal government can borrow money now and pay back less than it borrowed, after adjusting for inflation. Investment that resolves market failures, reduces future public expenditures, and improves economic performance also has precisely the cost profile that the pandemic recession calls for: high expenditures and job creation now, big savings later. President Biden’s proposal, which calls for $50 billion for improving resilience, is a good start.

Some projects that are already authorized and engineered, like repairing levees and clearing trees to fireproof communities, can provide immediate stimulus. So can investments that look like consumer purchases, such as installing rooftop solar or efficient appliances. Others will extend over years. But it may well take years for employment to return to pre-COVID levels—and even when it does, we cannot assume that labor markets will be as heavily weighted toward services, entertainment, and hospitality. Investing in a twenty-first-century workforce will require increasing the diversity, as well as the number of jobs.

Fortunately, particularly for fiscal hawks in both parties, many green stimulus opportunities will reduce costs and the deficit over the long term and foster stronger economic growth.

We will not be able to continue waving away our aging infrastructure or the increasing perils from climate change. If we do not reduce them now, the costs will be unavoidable and demand public resources when increased government spending may not be so appropriate.

Accelerating the clean energy transition by smart infrastructure investments like some of those proposed in the plan President Biden has outlined will cut American energy costs for consumers. In this way, green energy can play a role similar to that of the shale industry in the last recovery, yielding growth and jobs while helping consumers through lower energy costs. No other approach would yield such combined short- and long-term returns.