WeWork Is Why People Are Open to Elizabeth Warren and Bernie Sanders

My conservative friends often don’t understand why Elizabeth Warren and Bernie Sanders have so much purchase in American politics. Why don’t people appreciate the blessings of capitalism?

The free market has lifted more people out of poverty than any system in the history of man. This is just a fact. You can’t argue it.

And even if you were inclined to fixate on the downsides of market economics, why now? Unemployment is at historic lows and we’re closing in on a decade of sustained growth. Normally people get anxious about the system during a trough in the business cycle. We’re riding a wave.

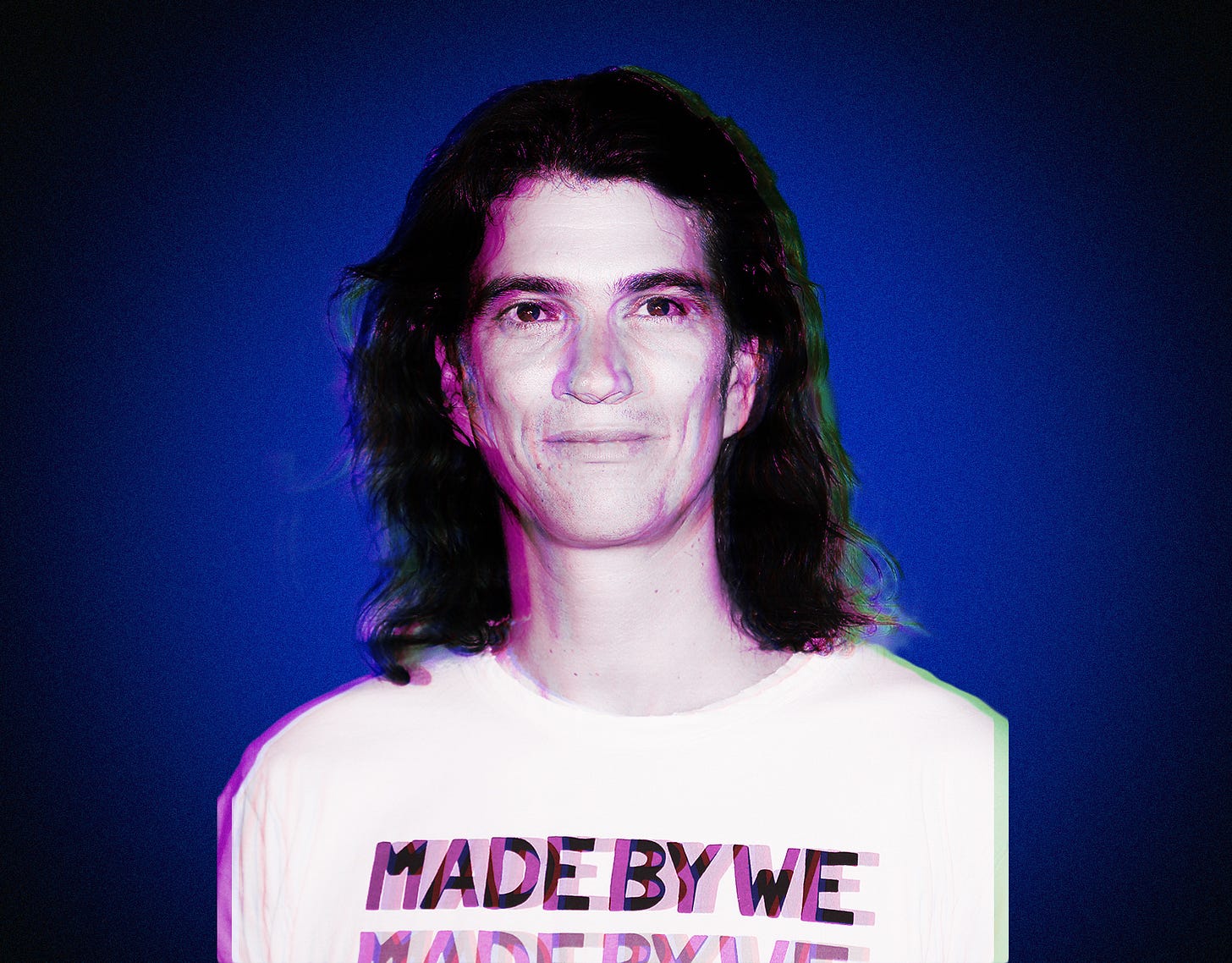

In answer, I’d submit to you the following headline: “How did WeWork’s Adam Neumann turn office space with ‘community’ into a $47 billion company?”

This story, from New York magazine, was written in June. That’s 18 weeks ago.

As of today, WeWork is not a $47 billion company. It is an $8 billion company, which may go to zero in the very near future. And the company’s biggest liability is Adam Neumann.

Neumann is such a liability that SoftBank, the Japanese megafund, is going to try to buy him completely out of the company. In order for WeWork to have any chance to survive, Neumann has to be excised, in toto.

And so SoftBank is preparing to offer him $200 million to go away.

Think about that for a minute: This asset, WeWork, will be worth $0.00 if its founder remains in control. But it might be worth slightly more than $0.00 if the founder leaves. So the bankers are going to pay this value-sink $200 million not for services rendered, but simply to disappear.

Yay, capitalism!

It gets worse. This $200 million payday will be on top of the $700 million dollars in phantom value that Neumann already extracted from the company before the rest of the market realized that WeWork was a sham. And it will be coming at nearly the same moment that WeWork lays off some 2,000 employees.

I don’t know anything about these workers. And I don’t know what sort of severance they’re getting, but I'm willing to bet that:

(1) None of these employees was such a negative value that their continued presence would have bankrupted the company, as Neumann’s was.

(2) None of them is going to be paid $200 million to stop doing something that’s killing the company.

Am I eliding some details? Yes. Is there nuance buried in here, somewhere? Sure.

But the broad strokes of the story are basically this: Adam Neumann created a company that was, if not an outright fraud, then deeply problematic. He profited from a series of market errors during the company’s rise. And now that the company is collapsing, he’s profiting again simply because he holds the tainted capital (voting shares) which helped poison the enterprise in the first place.

If Adam Neumann didn’t exist, Thomas Piketty would have had to invent him.