WeWork, SoftBank, and the Road to Socialism in Four Slides

I know what you’re thinking: Can’t we just let the WeWork thing go?

No. I can’t.

Tech writer Alex Wilhelm found the deck SoftBank is using to explain what just happened with their WeWork clusterfork and it is AMAZING.

The full deck is here but I want to pull out some highlights for you to feast on. Please keep in mind that this is the super-serious explanation the world’s biggest tech-investment fund is giving to its clients.

Because it looks like something Jacob Wohl scratched out on his iPhone.

Behold, here’s WeWork’s path to profitability:

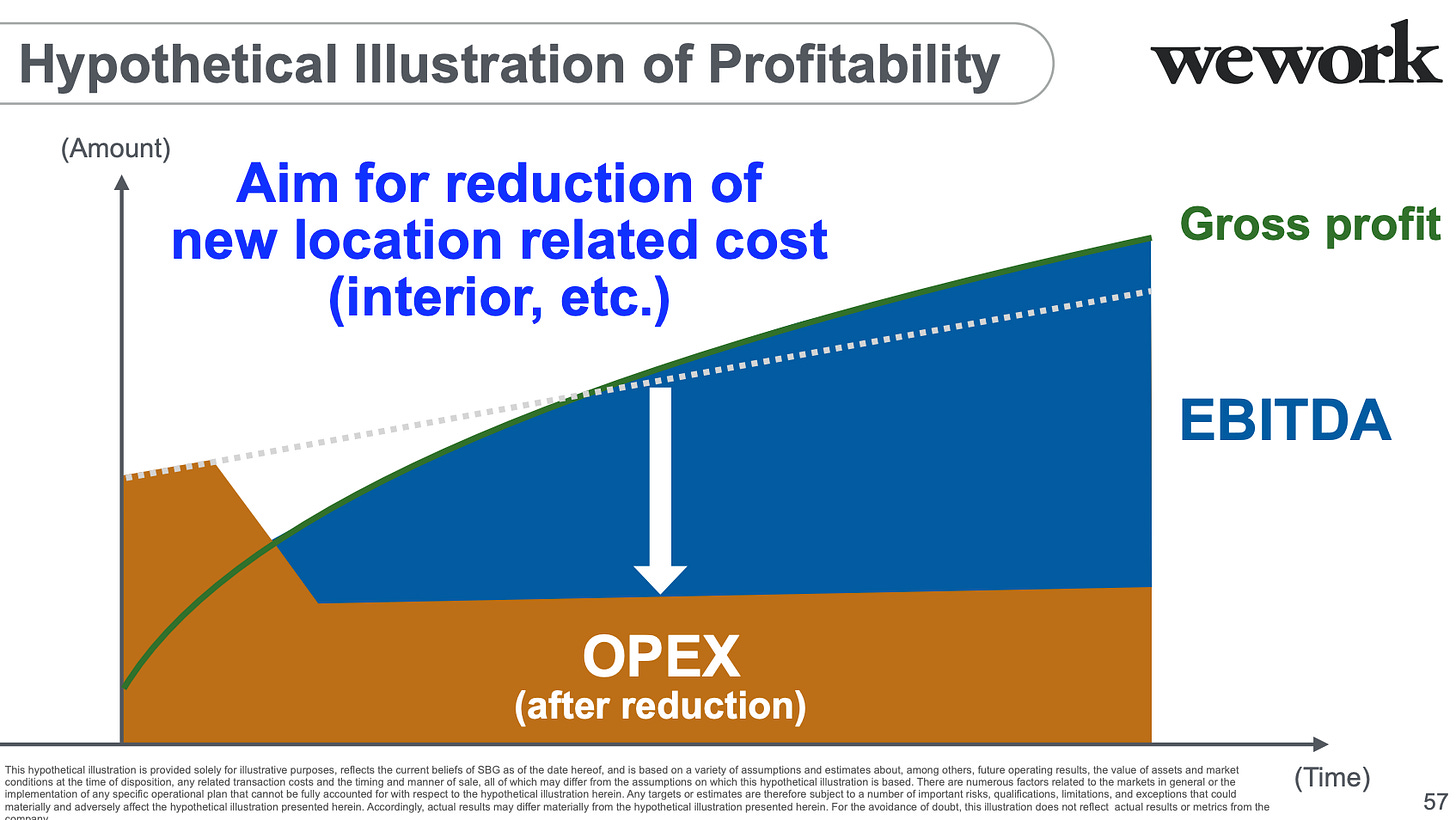

I’m sorry, is that too vague for you? Don’t worry, Masa has some details. This should make everything clear:

I’m sorry, now it’s too complicated? You think that looks like gobbledygook? Well that’s because you're not a supersmart capitalist who is ADDING REAL VALUE to the world day in, day out.

And if you can’t understand that chart, then maybe you ought to just sit back and keep your mouth shut, because if you were so smart then you’d be running a $100 billion fund, wouldn’t you?

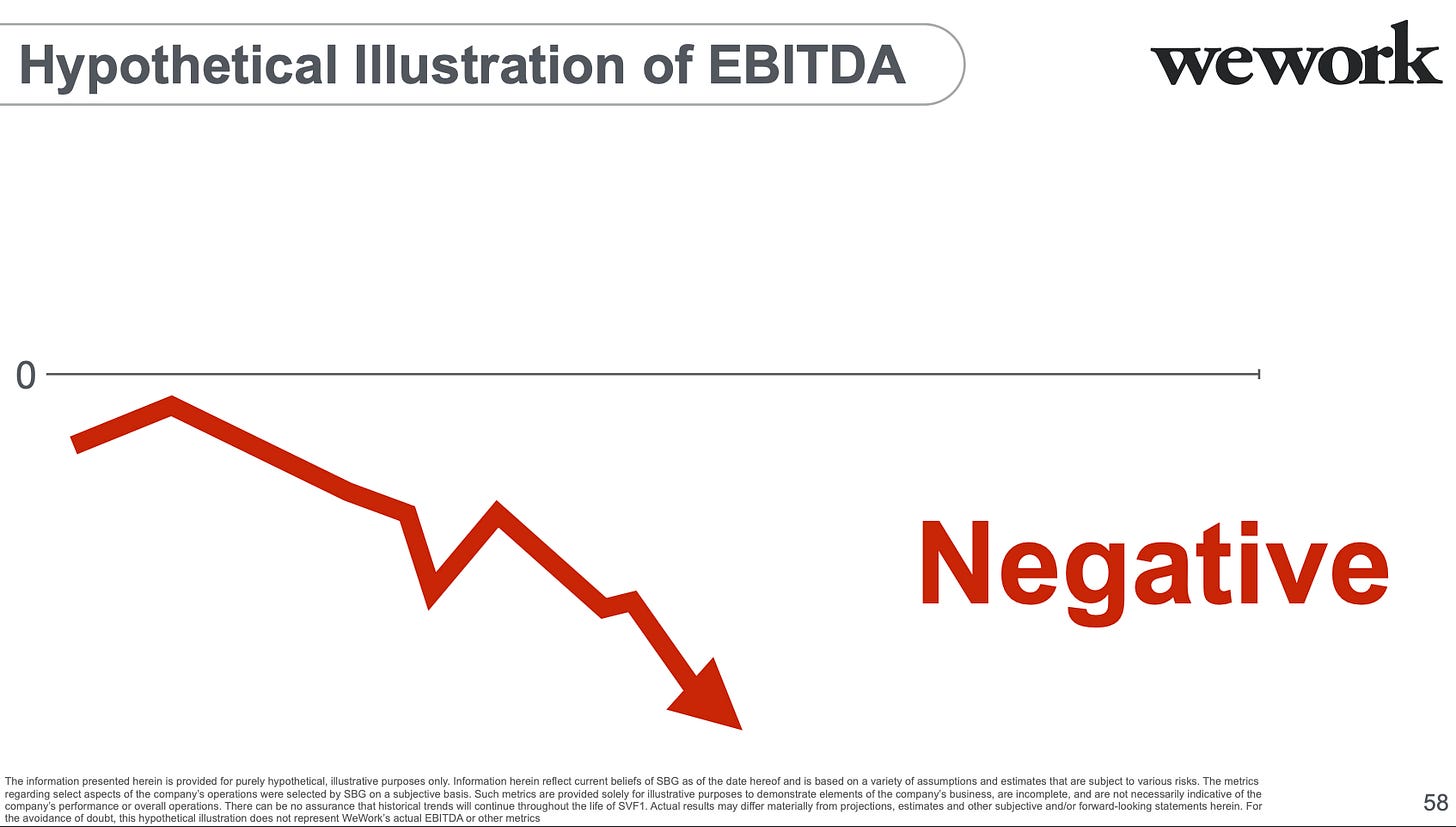

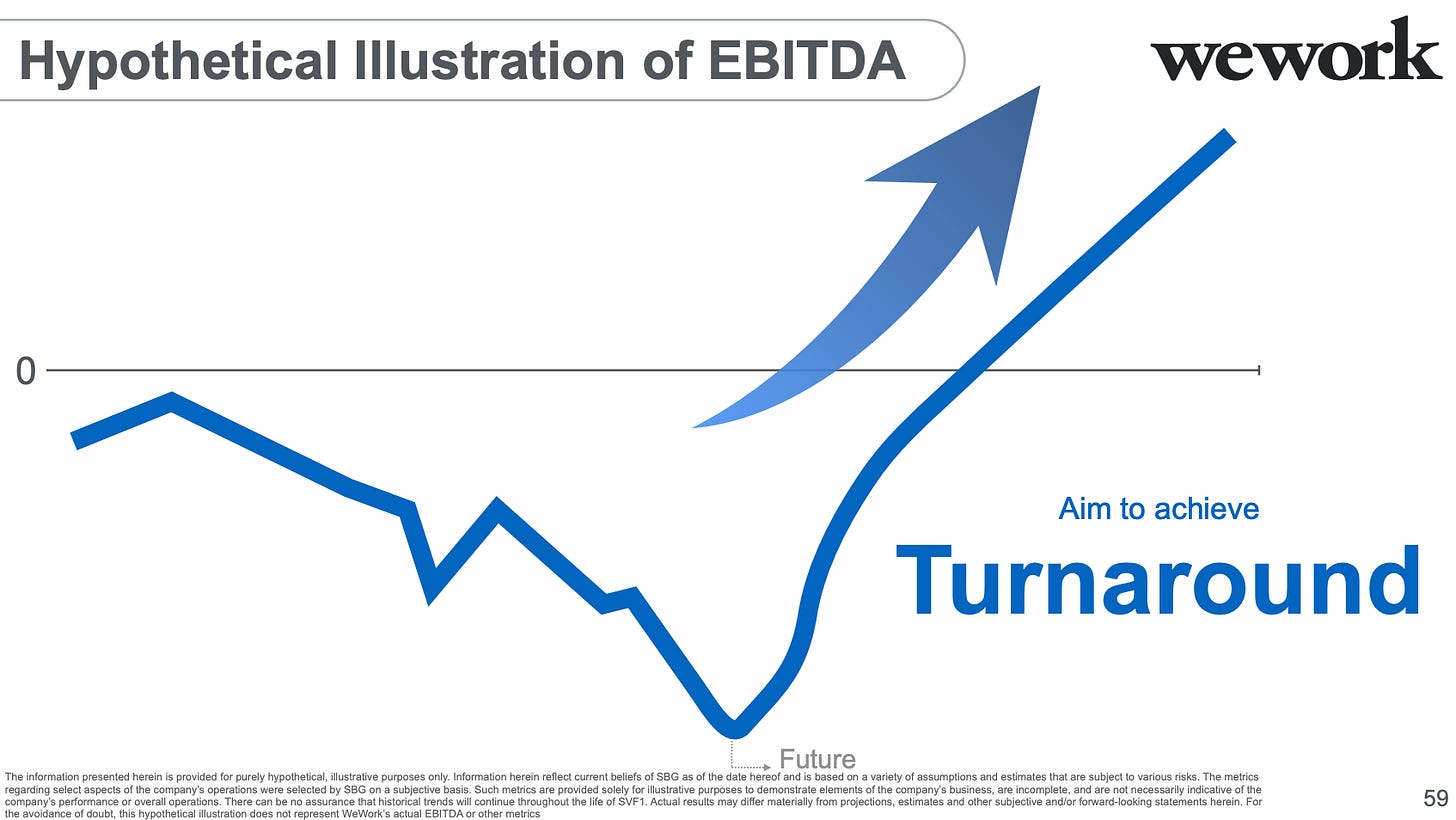

But the truth is, the people at SoftBank are not heartless. So they immediately follow that chart (which, as Wilhelm says, really ought to hang in the MOMA) with these two charts, just so all of the dummies out there can follow along:

BAM! Problem solved!

Let’s just do it and be legends.

Look, after reading the details of Elizabeth Warren’s healthcare plan, I was pushed closer to an embrace of full-bore, Reaganite capitalism than I've been in a couple of decades, because turning the market for research and development of pharmaceuticals into a command economy is a terrifyingly bad idea.

I asked myself how could anyone read Warren’s plan and think, Sure. Let’s give this socialism thing a try.

And the answer is WeWork.

I mean, the answer is not literally WeWork. But WeWork is a symbol—a giant Bat-Signal of a symbol—of the excesses of the free market. It’s a symbol of how divorced much of finance has become from reality. It’s a symbol of how the grifter who wrecks stuff gets to walk away with a billion dollars while the people working for the company and actually adding some value get kicked to the street.

But more than anything else: It’s a symbol of the fact that the smartest guys in the room may not actually be that smart.

And that’s what opens the door to Warren and Bernie and socialism.

I know that there are lots of fancy arguments about how, actually, WeWork and SoftBank were the private market, not the public market. And that SoftBank money comes from autocrats. And that the failure of WeWork’s IPO is a sign that the real marketplace worked. Each of these arguments is sort of true.

But also, not entirely true. Private markets and public markets are not hermetically sealed from one another. Money is fungible, so the dollars flowing from Saudi princes, to SoftBank, to WeWork distort markets that everyone else touches. Heck, Aramco—the Saudi state-owned oil company—is going to have an IPO in a few weeks, on the public market, even though many of the buyers of its stock may be literally coerced (I'm talking about wealthy Saudis who are being "encouraged" to support the IPO), which will distort its price, and then have downstream effects throughout the market.

If I were running the Warren campaign, I’d have these slides in rotation on a giant screen behind the candidate every time she walked onstage.